Credit Limits - this feature of the B2B Suite enables you to assign spending limits to wholesalers. This helps control how much credit a wholesaler is capable of placing without providing payment for their orders. If you allow, for example, a wholesaler to provide payment for an order 30 days after submission, then you can use the credit limit feature to control how much offline payments the wholesaler owes you.

Example

You have permitted IWD to join your wholesale program with a credit limit of $1,000. In this case, IWD cannot submit more than $1,000 in orders using offline payment methods such

as:check/money order (Net 30, 60), purchase order, wire transfer, etc. If IWD would like to submit an order greater than $1,000 then IWD will need to provide payment for this order when submitting it (via credit card).

Follow these steps to assign a credit limit to a wholesale company:

1. Go to Customers → Manage Companies and select a company

2. Navigate to the Payment Terms tab

3. To enable credit limits, set Activate Credit Limit to yes

4. In the Credit Limit box, enter the limit you are assigning to this company account

5. Once done, click Save

6. The Available Credit section will display the company's current available credit as determined by (credit limit - total of all orders pending payment)

7. To manage the credit limit message shown to the user at checkout, go to Stores -> Configuration -> B2B Suite -> Credit Limit and modify the message

- The credit limit value will automatically be added to the end of the message entered

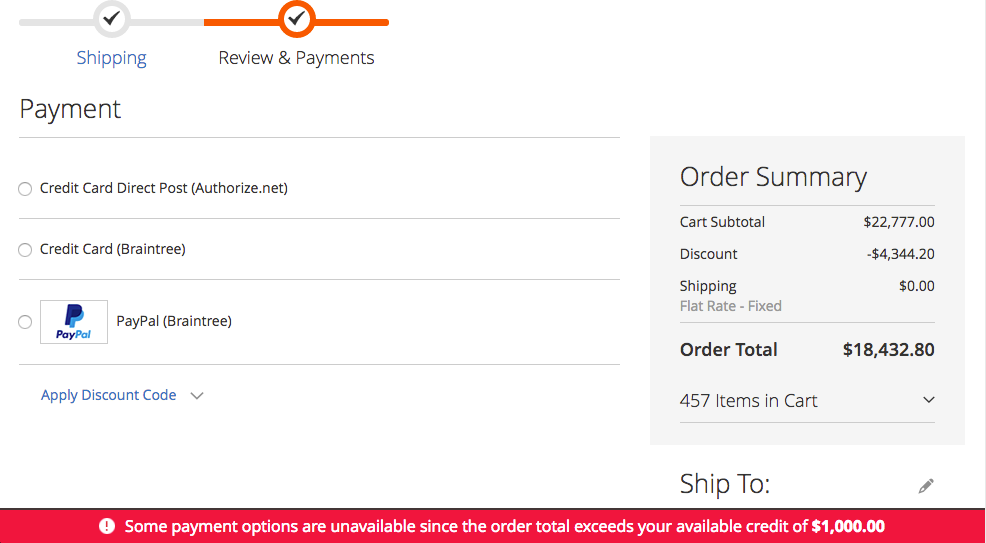

Note: if a wholesaler attempts to submit an order that is greater than their available credit then the following will occur:

- Message will appear at checkout that they have exceeded their available credit limit

- Payment methods that do not capture payment online / immediately will be removed (i.e. check / moneyorder, purchase order, wire transfer, etc.)